Advantageous

Get fast and straightforward services wherever you are. A single document is all it takes

Get fast and straightforward services wherever you are. A single document is all it takes

A direct lender committed to responsibility and innovation. We keep your data confidential and help in hard times

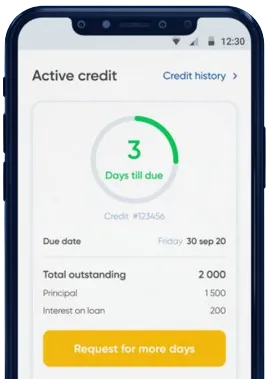

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Use the app to send your request, simply fill in the form.

Be on the lookout for our fast decision within 15 minutes.

Accept your funds, normally transferred in about one minute.

Use the app to send your request, simply fill in the form.

Download loan app

When it comes to financial services in Kenya, Tala loan has gained immense popularity among the locals. Tala loan, also known as a mobile loan, is a convenient and accessible financial solution for many Kenyans who are in need of quick cash. In this article, we will discuss the benefits and usefulness of Tala loan in Kenya.

One of the key advantages of Tala loan is its quick and easy application process. With just a few clicks on your mobile phone, you can apply for a loan and receive approval within minutes. This is especially beneficial for individuals who require urgent funds for emergencies or unexpected expenses.

Overall, the streamlined application process makes Tala loan a convenient and efficient option for those in need of financial assistance.

Unlike traditional loans that require collateral or a high credit score, Tala loan does not require any form of collateral. This makes it accessible to a wider range of individuals, including those who may not have valuable assets to offer as security.

Additionally, Tala loan uses alternative data sources to assess the creditworthiness of applicants, making it possible for individuals with limited credit history to qualify for a loan.

Another benefit of Tala loan is its flexible repayment terms. Users have the option to choose from various loan repayment periods, ranging from a few days to several weeks. This allows borrowers to tailor their repayment schedule based on their financial situation and ability to repay the loan.

Through its innovative mobile loan platform, Tala loan has played a significant role in promoting financial inclusion in Kenya. By providing accessible and affordable credit to underserved communities, Tala loan has empowered individuals to pursue their financial goals and improve their livelihoods.

Furthermore, Tala loan encourages financial literacy and responsible borrowing practices among its users, fostering a culture of financial independence and empowerment.

In conclusion, Tala loan in Kenya offers a range of benefits and advantages that make it a valuable financial service for many Kenyans. From its quick and easy application process to flexible repayment terms and financial inclusion efforts, Tala loan has become a preferred choice for individuals in need of quick cash. Its accessibility, convenience, and user-friendly platform make it a reliable and efficient solution for those seeking financial assistance.

Tala is a loan app that provides instant and unsecured mobile loans to individuals in Kenya.

To apply for a Tala loan, download the Tala app from the Google Play Store, create an account, and follow the instructions to complete your loan application.

To be eligible for a Tala loan, you must be a Kenyan citizen, have a valid national ID, be at least 18 years old, have an active M-Pesa account, and have a good repayment history.

The loan amount you can borrow from Tala depends on your credit score and repayment history. New borrowers usually start with smaller loan amounts which increase as they build trust with Tala.

Tala charges a service fee of between 7% - 15% based on the loan amount and repayment period. The interest rate is calculated on a daily basis.

To repay your Tala loan, go to the Tala app, select the 'Repay' option, and follow the instructions to make a payment using your M-Pesa account.